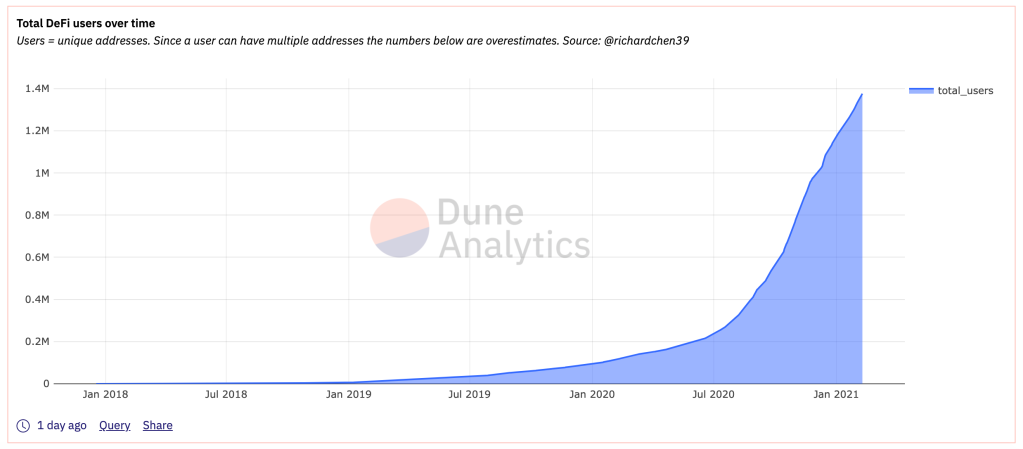

Over the last few months, the Decentralized Finance ecosystem has grown at an impressive pace: every single metric you can look at shows double digits growth on a month by month basis.

This is a great achievement, but it is a fact that so far speculation or high risk financial incentives have been the main adoption drivers for Defi (and the wider crypto space). This isn’t negative per se, as it led to the creation of interesting applications and facilitated the evolution of a proper ecosystem, but this is not enough to get to 100 million users. To get to 100 millions users a new set of use cases must be developed. The argument of this post is that DeFi has a great opportunity to build products in fringe alternative asset classes, in particular music royalties and art.

Fringe alternative classes today

In a world where interest rates are sub-zero, single digits return asset classes are extremely interesting for investors. In this scenario, music royalties and pieces of art – with a total asset base estimated north of $ 3T – are becoming more and more appealing for investors.

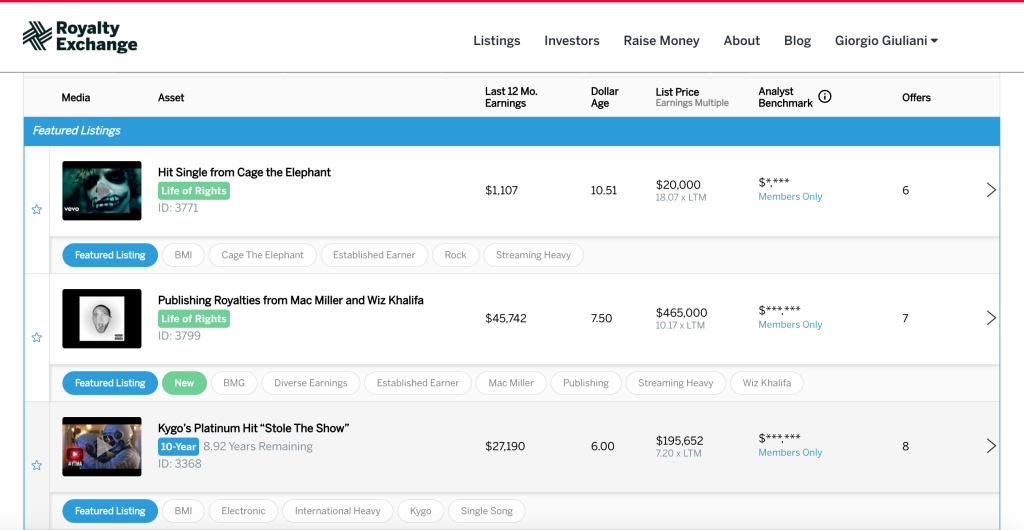

These “creative asset classes” are dominated by institutional or hyper-wealthy investors, with essentially no access for retail investors. A Robinhood for art and music asset classes simply doesn’t exist. Some marketplaces in these spaces (Masterworks.io for art or Royaltyexchange.com for music, Otis for collectibles) are live but they present some clear entry barriers: fractional ownership is not always guaranteed, their catalogue is limited, they are invitation-based and not open to the wider market.

Music, Art and Blockchain

Music and Arts are not new problem spaces for blockchain, as many projects have been focused on innovating those two domains using DLT applications.

On the music front, there are various companies that are re-imagining how the music industry can be improved. Noticeably among them is Paperchain – a payment solution that shortens the payment cycle for creators, based on their streaming stats.

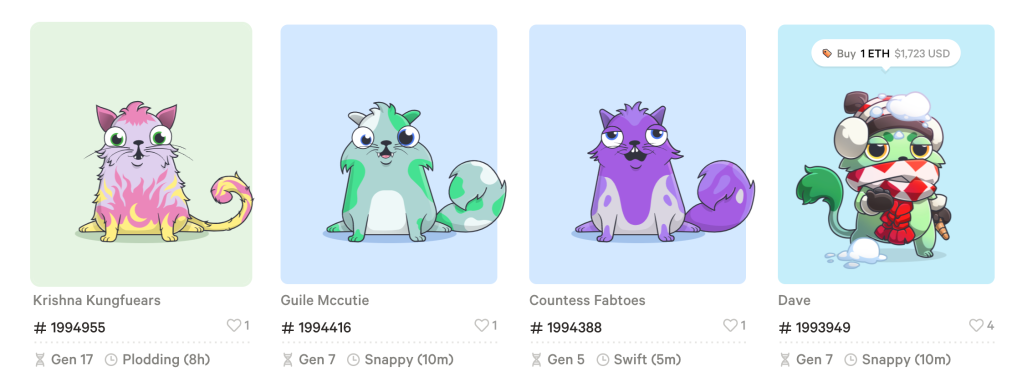

On the art scene, NFTs are probably the hottest thing in crypto today. Non Fungible Tokens are unique and not interchangeable tokens, the opposite of cryptocurrencies where every token is interchangeable and not unique. NFTs have been used to create digital scarcity in several specific applications that require unique digital items like crypto art (Cryptopunks), crypto-collectibles (CryptoKitties) and crypto-gaming.

Over the last 6 weeks a number of incredible deals took place, with thousands of Eth (millions of $) spent to buy NFTs from groups of digital artists and the NFTs asset category really taking off (you can find an overview of the topic here).

These new projects are tremendously cool and highly innovative: they are exploring the concept of value in relation to physical objects and their ideal counterpart (ideal in Platonic terms), and are pushing the frontier of arts and capitalism to unexplored territories.

Anyway they are complex products: hard to discover and even harder to understand, far removed from our neighbours, the Joes and Janes on planet Earth. I’m sure NFTs will grow exponentially and will probably be the coolest thing in crypto in 2021, but they won’t drive mass market adoption – if not for other speculative reasons.

A mass market approach

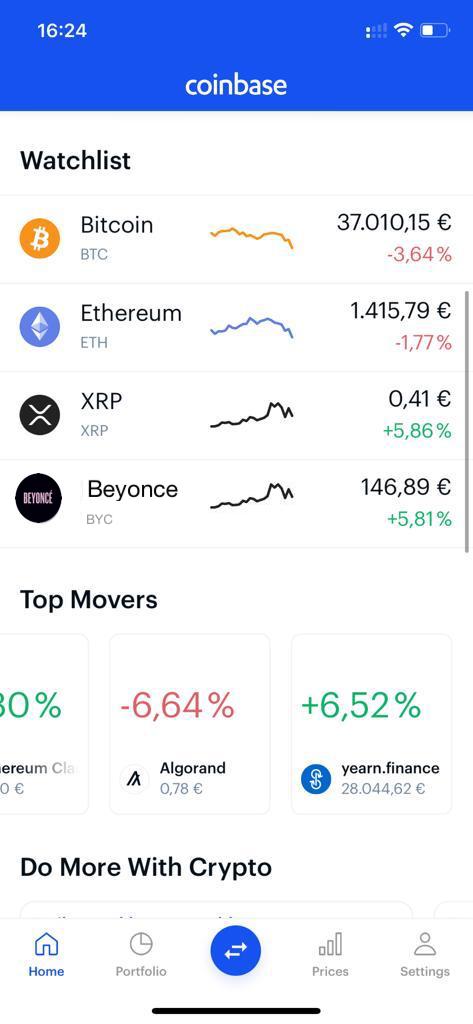

Imagine a scenario where a popular crypto aggregation point with a wide distribution (an exchange/wallet like Coinbase or Argent) decides to onboard a new type of tokenized asset: the streaming royalties of the latest Beyonce album.

This token will probably be an ERC20 compatible token that can be traded over the Ethereum blockchain. Based on the number of Spotify streams the token will generate a steady cash flow over time, and the same asset could eventually be used on Aave, Compound, MakerDao to get a loan.

My sense is that a number of elements could make this feature a mass market one:

- Better UX: considering the amounts of barriers to entry to the art/music marketplaces presented above, it would be much easier for Joe or Jane to download Coinbase and buy the Beyonce album token in a few taps. This token would promise higher returns than the vast majority of asset classes today, it would be much more liquid than an investment on Royalty Exchange and could be used to get access to other financial products (it could be a potential collateral).

- Better distribution: Coinbase is a fairly popular app, so it wouldn’t be too problematic for the average investor to get the news that it is possible to buy a Beyonce token.

- Emotional attachment: fans would be in a unique position to show their affection and support to their favourite artists, this would create a bondage with the product that cryptocurrencies will never achieve at scale. This feature would move crypto beyond arbitrage and utility, towards a more popular movement (not far from what happened two weeks ago with Gamestop and r/Wallstreetbets)

Conclusions

What DeFi and the decentralized finance movement achieved so far is incredible, but this is still a tiny fraction of what traditional finance moves every day. To attack the traditional financial system I believe that a typical strategy of the classic startup theory should be followed: optimise for an underserved niche, dominate that segment and then move on to the next one, one by one till conquering the entire financial space.

Especially in a post-pandemic world that craves owning emotions, Arts and Music could be powerful hooks.

Thanks to my friends Angelo Min Tagliabue and Luca Cosentino for their kind and extremely valuable review of this post.