After some time I had the opportunity to go through another 10K analysis with my fellows of the Fintech product guild. This time we decided to analyze Square.

I heard a lot about Square in the news recently but, as I am not based in the US, I didn’t really perceive it as a consumer product and I expected to find a SMB-first company that eventually launched a retail product.

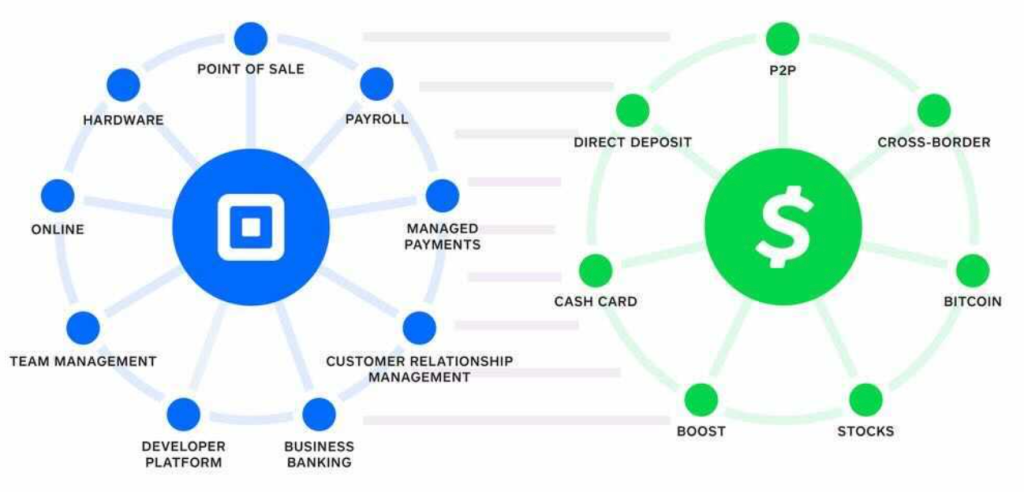

I discovered a much different reality. Square includes two very strong propositions: a Seller one, and a retail one – Cash App. They live under the same company umbrella, but they are solving two completely different problems.

Income Statement

Last year was pretty good for Square: the company grew a lot and managed to face COVID quite well: total revenue doubled (+101%) and the gross profit grew (+45%).

The operating costs grew in line with the revenues’ growth, especially on product development and sales and marketing: the company is betting on its growth and it is investing the extra revenues in acquiring new users and building new features.

Looking at the group Income Statement a few other elements caught my eye: first, the explosion of the ‘Subscription and service-based revenues’ (+45% yoy), which is mainly driven by the Cash App adoption and usage of Instant Deposits and Cash Card; second, the evidence that Hardware is a pure acquisition feature for Square Seller, with a loss of approximately 50M in 2020.

Being Square a transactional business, it is interesting to zoom in on the Transaction-based revenues: the Gross Processing Volume grew even though less than 2019, probably impacted by Covid; the Gross Profit went better, mainly due to the increase in card-not-present transactions [+26% vs -4% of card-present txs] which are more profitable for Square.

The ecosystem creation playbook

To fully understand Square it is very useful to analyze the different behaviours of the two sides of Square’s business: Seller and Cash App.

The Seller side growth was severely affected by COVID (especially by a terrible Q2-2020) that flattened its growth (Gross profit growth from +30% to +8%) but remained solidly profitable with over $1.5B of Gross Profit.

On the other side, Cash App exploded with 3 digits growth in each of the revenue streams: Transactions, Subscriptions and Services, and Bitcoin.

The Bitcoin feature was the hit of the year: 3 million users bought BTC through Cash in 2020, and 1 million in January 2021 only. Bitcoin revenue went up over 700% but so did Bitcoin costs, as the company recognizes as revenue the sale amounts received from the customers and as a cost the associated bitcoin cost – essentially neutralizing the impact on the IS.

What really jumps out is the impressive +125% of the Subscriptions and services-based revenue, made mainly through the wider adoption of 2 core features of Cash App: Instant Deposits and Cash Card. A strong usage pushed up by the massive growth in MAU of the app.

Overall, what seems evident from the analysis is that the core value that Square brings to the table is its mastery in building new ecosystems around an underserved customer base.

They really defined a playbook for ecosystem creation and they are applying it to the SMB customer and to the retail one. In my understanding this playbook works as follow:

- Identify an underserved user, who has a very fragmented financial experience based on stitching together products and services from multiple vendors (probably not digitised yet)

- Focus obsessively on a core pain point for this user: Card payments for SMBs, P2P transfer for consumers

- Use that core use case as an acquisition feature

- Build a constellation of profit generating services around to deliver a ‘cohesive, fast, self-service and elegant experience’

Seller and Cash App are nothing else than two iterations of the same playbook, only at different stages of maturity: Seller quite mature, Cash App still in exponential growth.

Looking at the future

The future looks brilliant for Square.

In the short run, the growth of Cash App is obvious and I believe they are only at the beginning of the journey: Cash App can become the dominant wallet in the US and, given its positioning in the crypto space, it also has the features and the sophistication to intercept new developments in the financial ecosystems – something very hard for traditional banks but challenging also for most of the consumer Fintech companies.

Also, the company just closed the Tidal deal which brings many opportunities in the music and creators space: creators can become another underserved user to build an ecosystem around – more in one of my latest posts.

Looking at the long term, I believe that Jack Dorsey’s vision is to connect the Seller and Cash App ecosystems to originate a new closed loop payment network – eventually based on blockchain rails – fully disintermediating Visa and Mastercard. The company has everything in place to do it: it is quickly ramping up the two sides of this 2-sided marketplace (sellers and consumers) and building two extremely solid customer bases that, once integrated, could create a financial giant very hard to compete against.