Decentralised Finance or DeFi is definitely one of the most fascinating topics at the intersection between technology and finance nowadays. The Ethereum-centric movement, which started less than five years ago, now has a total market cap of more than $150B and really represents a parallel financial system based on blockchain rails with all the properties that this entails.

For this reason, together with some fellow guilders of the Fintech Guild, we decided to analyze the most critical DeFi protocols around. We decided to kick-off with Compound.

Compound is a money market protocol that allows users to lend and borrow crypto-assets in a global, permission-less, transparent and very rapid way, without a middleman.

It represents one of the pillars of the DeFi movement: it stores approximately $ 10.5B of TVL (total value locked), it showed an enormous growth over the last 9 months and it captures approximately 40% of the lending activities in the Ethereum space.

The protocol solves two crucial problems in this parallel financial ecosystem: it brings time value to the asset supported and it creates an automated money market.

Time value – the concept that, due to its potential earning capacity, the value of an asset now is higher than the same sum in the future – wasn’t really supported in crypto before the introduction of Compound. Compound natively integrated this feature.

Moreover, Compound creates an automated Money market: a decentralized system that offers frictionless borrowing of ETH and other supported ERC20 tokens

Protocol analysis

SUPPLY SIDE

Let’s say a user wants to lend 10 ETH on Compound and get some nice interest out of them. The user will go on the website, or access the protocol programmatically, and deposit their ETH in a supply pool. In exchange they will receive an equivalent value of cTokens.

cTokens are Interest bearing tokens, so tokens that represent a claim over the underlying asset plus an interest rate. If the user changes a cToken some time later, they will get the original asset plus extra value, guaranteed.

cTokens are nothing more than claims over the supply pool of a specific asset that will then be borrowed out to borrowers. cTokens also have other nice properties: they can be transferred outside of Compound and used as a collateral.

From my point of view, cTokens are one of the biggest innovations that DeFi brought to the financial ecosystem. This is an incredibly useful product because it links a very common financial product – an interest bearing asset – with a very efficient distribution technology – tokens on a blockchain. This product makes something that today is very inefficient and sophisticated, like exchanging a loan between banks or transferring the claim on any form of interest bearing asset, extremely easy .

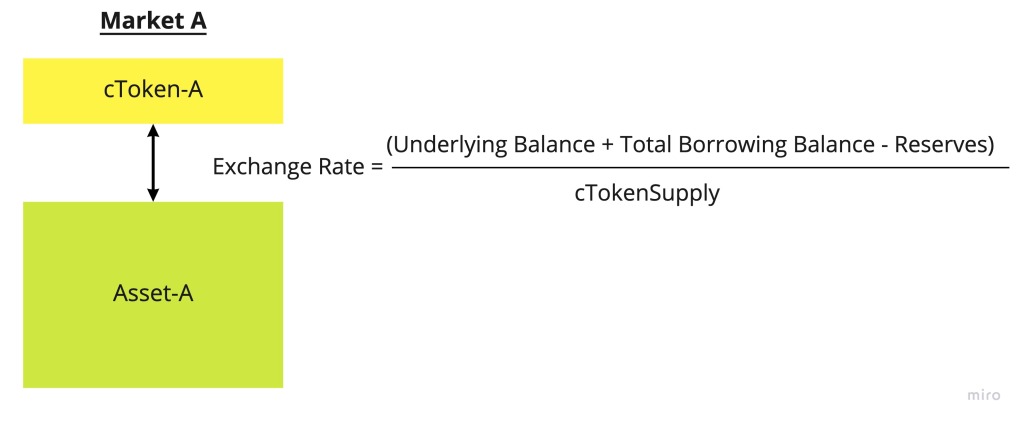

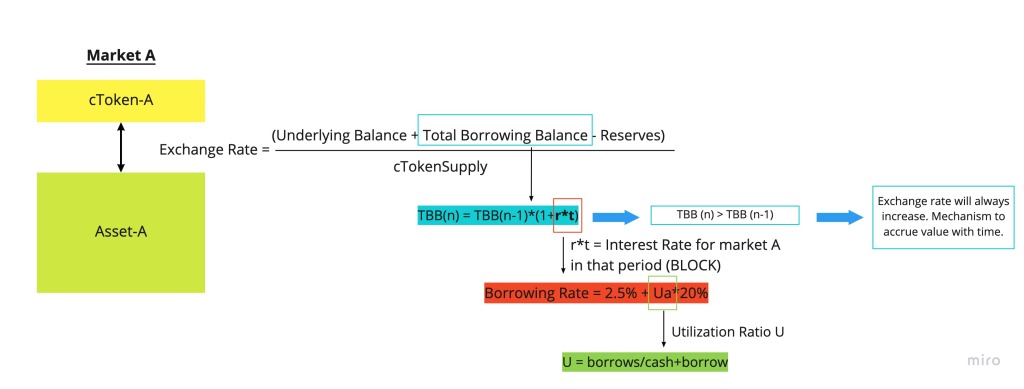

As mentioned before, cToken can always be converted into the original asset, based on the exchange rate of the moment.

The Exchange Rate is the mechanism used to accrue interest. When a market is launched, the cToken exchange rate (how much ETH one cETH is worth) begins at 0.020000 and increases at a rate proportional to the compounding market interest rate – the interest rate paid by borrowers. Find below more on the specifics of the exchange rate.

For example, let’s assume our user deposits 1000 DAI into Compound at T0 when the exchange rate equals 0.02007. At T1, the exchange rate will be always bigger – this is guaranteed by the structure of the protocol – and will be equal to 0.02011. This is equivalent to 1001.98 DAI.

Those 1.98 extra DAI represent the interest rates accrued over the time window.

One underestimated property of cTokens is that, in pretty much all jurisdictions, they convert what would usually be “income” (interests) into “capital gains” which is always taxed at a lower rate.

This is because from an accounting perspective you are buying an asset, the cToken, at a specific rate and then selling it at another rate realising capital gains.

DEMAND SIDE

On the other side of the marketplace, let’s imagine a user wants to borrow some DAIs: they can go to Compound and get them in exchange for some other assets, for example Ethereum.

The user will deposit Ethereum, more than the value that is asking to borrow as the loan has to be overcollateralized, and they will automatically get the DAI in exchange.

That order will be executed very quickly because Compound collects all the supply assets in pools, so there is no need for the borrower to wait for a matching order on the lending side.

Under the hood, when the users post their collateral, those assets are transformed into cTokens that are used to over-collateralise the loan – and thus cannot be transferred.

Based on the collateral factor of the assets used as collateral (ranging from 0-1) Compound will calculate the total borrowing capacity of the borrower (combination of #cTokens*price*collateral factor), so essentially the maximum value that the borrower will be allowed to borrow.

Users will be then only allowed to borrow up to their borrowing capacity and no further.

The borrowers will pay an interest rate on the loan that will then be distributed to the lenders through the cTokens.

The interest Rate of each market is a function of the Utilization Ratio – so of the demand of the asset – and it is updated every block.

If the outstanding loan of a user exceeds the maximum borrowing capacity (because the value of the collateral goes down), a portion of the outstanding debt may be repaid in exchange for collateral at market price minus the liquidation discount.

This process is called liquidation and it is the defi-way to “margin call” users. It is a measure that guarantees the integrity and stability of the lending ecosystem.

To ensure decentralisation and fairness of the protocol, liquidations are performed by external parties called keepers. Anyone can become a keeper and compete to get the liquidation premium offered for performing this service to the protocol, a very competitive but also very lucrative business.

GOVERNANCE

Governance is a critical topic in many blockchain projects, something completely new for people coming from TradFi or even Fintech. In many of these protocols, users own governance tokens and have the right to influence the protocol’s evolution and exercise an actual power, much more real than a theoretical leverage on a product as “customer”.

Compound started as a fully centralized protocol, i.e. the admins had the power to create new markets, define interest rate model for a token, date the Oracle address, withdraw reserves of cTokens. Then, in April 2020, it moved progressively towards decentralization, substituting a single admin entity with a community of COMP holders – COMP is the token that was distributed to the protocol users, proportionately to their activities on the service.

Compound’s governance is now one of the most robust in DeFi: COMP holders don’t vote on vague written proposals but they actually vote on committed code. If the vote goes through then the code goes live so there is no uncertainty on the implementation.

The full decentralization of the governance will probably put Compound in an even more central position to the DeFi space, even though the discussion around pros and cons of a decentralized governance is extremely controversial and beyond the scope of this post.

Conclusions

Compound’s business model is extremely solid, as it takes a cut of the interest rate paid by the borrowers. As the volume of originations will go up, their chunk will grow too.

If we want to make an analogy to the traditional finance system, Compound is a mix between a money market and repo market. It represents a marketplace for extremely liquid assets. Even though, in contrast to traditional markets, its access has no restrictions:anyone with an Ethereum wallet can access Compound.

Yet, the type of use cases supported are clearly directed to practitioners of the space that are actively trading or are building more sophisticated financial products. I doubt that the mainstream user will ever be aware of Compound as they may not be aware of the repo market existence today.

Compound has seen a tremendous growth over the last 12 months, mainly fuelled by being one of the central protocols of DeFi. As the DeFi space will evolve and intersect with TradFi use cases, I expect this protocol to become one of the pillars of this future hybrid financial system and to see further expansion, orders of magnitude bigger.

Compound is one of the pillars of DeFi but to grasp the logic of the DeFi ecosystem, other foundational pieces have to be analyzed. Stay tuned for the next protocol: Uniswap.

Thanks to my friends Luca Cosentino and Angelo Min Tagliabue, for their kind and valuable feedbacks and reviews on this post.

Resources

- Compound Whitepaper – LINK

- Compound protocol on GitHub – LINK

- Compound cToken Introduction – LINK

- Compound Demand side – LINK

- Compound Supply side – LINK

- Defi Pulse on Compound – LINK

- Dune Analytics Compound users – LINK

- Dune Analytics Lending Dashboard – LINK

- A16Z: Progressive Decentralization – LINK

- Podcast: Robert Leshner on Epicenter – LINK