In Roman mythology, Janus was the god of beginnings, transitions, and endings. He was depicted as having two faces looking in opposite directions, symbolizing his ability to look both to the future and the past.

Janus offers the perfect metaphor to solve one of the most important pieces of crypto infrastructure: on/off-ramp.

In the context of crypto, an on/off-ramp refers to the channels through which users can convert fiat currency or other traditional assets into cryptocurrencies and vice versa. Essentially, an on-ramp enables users to enter the crypto ecosystem (converting fiat into crypto), while an off-ramp enables them to exit it (converting crypto into fiat).

These on/off-ramps can take various forms, but most often, they are centralized exchanges or stablecoins. Over the last months, both these categories were under pressure, first with the FTX bankruptcy, and later with the Signature and Silvergate troubles, which created enormous problems for USDC and some centralized exchanges’ users.

The solution to these problems and a new paradigm for on/off-ramps could come from a Janus-inspired Icelandic service: Monerium.

Monerium

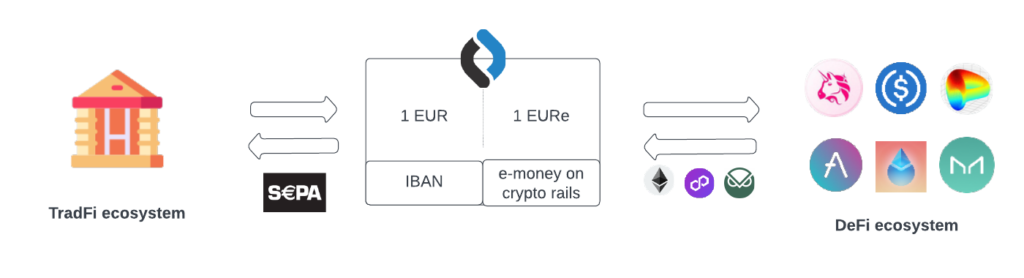

Monerium uses an existing monetary instrument – e-money – in conjunction with blockchain rails to offer a radically new solution to the on/off-ramp problem.

Their product is an account synced with a crypto wallet and a traditional bank account with IBAN. The crypto wallet is an EVM wallet currently working on Ethereum, Polygon and Gnosis Chain. The IBANs are generated through SatchelPay a payment service providers based in Lithuania.

When a user deposits € 1 to the IBAN account, the same € is automatically also available in the form of EURe, the e-money token issued by Monerium.

This particular e-money token is officially approved as a legal form of cash, and, in parallel, it is compatible with crypto rails, as it can be transferred over blockchains to other EVM compatible wallets.

In order to issue EURe, Monerium has obtained an e-money institution license, authorized and regulated by the Financial Supervisory Authority of the Central Bank of Iceland. As with every EMIs, Monerium can only safeguard user funds and, unlike banks, cannot make loans.

EURe, A new breed of stablecoins

From my point of view, EURe represents a true innovation in the stablecoin game. To be more precise, EURe is not really a Euro-stablecoin because it is not simply pegged to the €; it really is € in e-money form.

As e-money tokens, EURe tokens have some very interesting properties:

- EURe are officially approved as a legal form of digital cash, i.e., e-money

- Priority claims on safeguarded assets held in segregated accounts

- Overcollateralized at 102%

- Safeguarded in short, high-quality, and liquid assets (sovereign or corporate bonds) or with banks

- Redeemable on demand

Looking at the EURe proposition in more detail, it is important to mention that, naturally, there are downsides.

First, as with other more popular stablecoins, EURe presents some counterparty risks. Their deposits are held at commercial banks (details not disclosed), and despite its depositors being guaranteed up to €100K, bank bankruptcy is still a risk. In case one of those banks went bust, a liquidation process would start, and depositors (turned creditors) would have to wait until the end of this process before getting back in possession of their dues, with obvious implications on the EURe’s redeemability. A Central Bank account would provide more guarantees, but unfortunately, it is not something Monerium managed to obtain yet.

Moreover, EURe is a very powerful tool, but it needs more liquidity to be usable.

As of today (23-03-2023), the total supply of EURe minted is less than € 5M across the three chains (Etherum, Polygon, Gnosis Chain).

In addition, to practically use EURe in the DeFi ecosystem or deploy capital into major DeFi protocols, it is still necessary to convert it into other stablecoins on Decentralized Exchanges (mainly Curve). This problem will easily be solved as soon as EURe gets enough traction. Whitelisting in a lending or interest rate protocol (like Aave or MakerDao) may speed up its adoption.

Conclusions

Readers of this blog know that I believe in the convergence of traditional and decentralized finance. More explicitly, I think financial services will ultimately use blockchain rails because they are more transparent and efficient.

In this picture, bridging tools that can speak to both worlds is the logical next step.

Through this lens, Monerium, despite some criticalities, represents the most advanced stablecoin project in circulation and the most ambitious one. Instead of adding sophisticated financial engineering artifacts, Monerium worked on creating a product more closely connected to the source of the value of any fiat currency in circulation: central banks.

The result is an elegant experience that brings stablecoins to a new dimension, as, ultimately, Monerium created fiat money usable on crypto rails. In other words, a Janus-coin.