Over this quarantine, I’ve decided to invest some time in a renowned Coursera course on Banking. The course is great and one of the core concepts of the class is the Hierarchy of Money. Being myself very interested in cryptocurrency, I’d like to explore in this post where Bitcoin sits in this hierarchy.

First of all, what is the hierarchy of money?

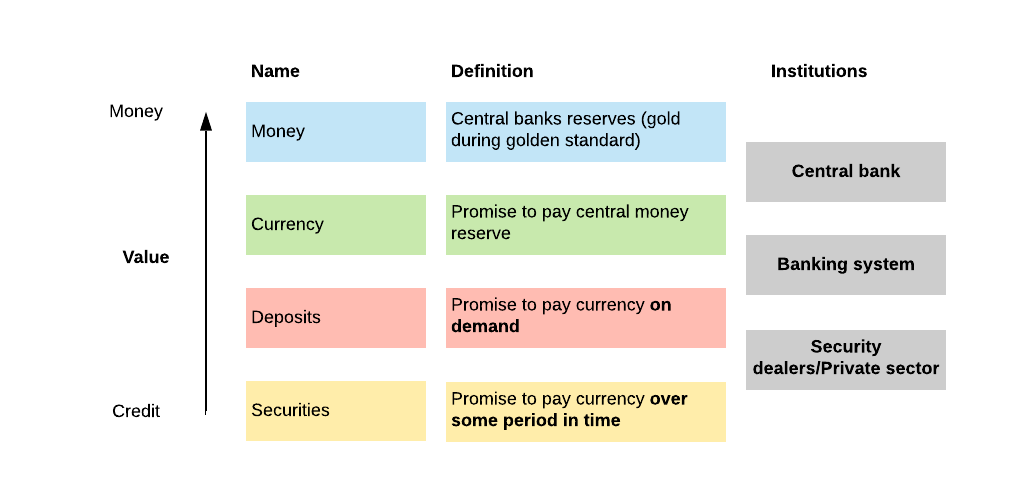

Even though every dollar looks the same, not every dollar has the same value. To fully understand this we have to first clarify a core concept: every dollar is essentially a promise to pay from somebody, an IOU. The more this debtor is trustworthy, the more your dollar has value.

Thus the hierarchy of money can be thought of as a multi-tiered pyramid where the tiers represent IOUs (promises) with differing degrees of acceptability.

Considering the Balance sheet of the institutions involved, the underlying pattern is fairly straightforward: any entry in the system is ultimately a promise to pay from somebody else, except for the central bank reserves, that represent the single trustless element in the system.

This interconnected system creates a pyramid of money and institutions which differ both qualitatively and quantitatively.

It is usually possible to move from one layer to the other paying a discount (exchange rate, par rate, interest rate). Actually, in periods of boom, credit is perceived as valuable as dollars and this discount goes to zero. But during a crisis, the situation changes brutally, and it might be even impossible to move up in the hierarchy (if nobody wants to buy my credit, I can’t convert it in any more liquid form of money).

A fundamental property of the hierarchical system is that, as currency demand goes up and down, supply can be adjusted elastically through these layers without losing a component of discipline (at the end of the day, you have to settle your obligations).

This is probably the most important feature of our monetary system: it allows us to manage the systemic fluctuation of the money market without constant crisis. This is not a trivial property because, as Allyn Young clearly explains in this paper, before the creation of the FED, the system was totally inelastic and systemic liquidity crises were ordinary.

Where does the Bitcoin sit?

Bitcoin is a crypto currency who runs on a decentralised ledger technology and which presents one core property: it is artificially scarce, a total number of bitcoin has been planned and no other Bitcoin will be issued in the future. This scarcity is widely considered by the BTC dogmatist as the ‘killer application’ of the product, the real competitive advantage over the concurrent monetary systems.

With these concepts in mind, a few hypotheses can be made on the position of BTC in the hierarchy.

Hypothesis 1 – bitcoin is not part of the monetary system, it is an asset

Bitcoin is not really an ultimate reserve of value, it is an asset. It is traded in the lower rank of the pyramid as any other security, but it doesn’t constitute the foundation of a new system.

In this scenario, BTC is not very different from other commodities: it can be seen as a safe haven, but it doesn’t ultimately represent a risk-free asset, its value depends on the market made around it.

Hypothesis 2 – bitcoin as the top of a new pyramid

This is what is mainly believed by Bitcoin dogmatists and activist investors. In this world BTC is essentially the ultimate safe haven, if there is a crisis anybody wants it because it is the most valuable asset, being at the top of a brand new monetary standard. This is a more fascinating scenario, but I believe it is very far from reality today.

Ignoring the obvious scalability issues (today around 7 transactions per seconds are guaranteed by the Bitcoin chain, orders of magnitude less than what would be needed in this eventual new world) if BTC has to become the cornerstone of a new monetary standard, this standard lacks probably the most important feature of any monetary systems: elasticity.

We find elasticity in every layer of the current monetary system: we find it in the intraday liquidity operations for settlement, we find it in the overnight repo market, we find it in the ultimate ability of a central bank to act as lender of last resort.

All the features mentioned above are very nice properties that allow the global monetary system to act as a giant settlement infrastructure, smoothly enabling transactions between agents. The same transactions wouldn’t eventually be all possible in a BTC monetary system, because that system has a cap in amount of currency available and if the demand would eventually exceed the supply, some transactions would necessarily be stopped, with consequent liquidity crises.

Conclusion

I believe that Bitcoin today is obviously an asset and it’s very hard to see it as the new foundation of a future monetary system, simply because there isn’t any system built around it: there isn’t a central bank which can introduce an elasticity component through credit and there aren’t transmission channels of this elasticity to the wider economy.

On the other side, there is a strong discipline embedded in the BTC design which I believe, if complemented with credit – the other crucial pillar of a sound monetary system – could represent a promising start for a new global monetary system that goes beyond the existing global dollar standard.