The last session of the Fintech Product Guild `10k-a-month club` was centered around one the most interesting companies in circulation: Shopify.

Shopify was established with the goal of making e-commerce very simple for anybody: the company provides a set of tools to bootstrap an online shop and essentially remove a lot of technical hurdles from the setup of an e-commerce, letting entrepreneurs focus on the commercial side of the venture.

Recently, they started adding a comprehensive set of financial features to their product, embodying the paradigm of embedded finance that I already touched in one of my previous posts.

The goal of this post is to deep-dive into these features and analyse their strategic impact.

Financials analysis

Income statement

Shopify grew massively in the last 12 months, reaching over 1 million merchants on the platform and a GMV (Gross Merchandise Volume) of more than $60bn.

This is obviously an insane number, but it’s still less than a third of what Amazon generates through its Marketplace business, and less than 20% of Amazon’s entire GMV .

That GMV translates into $ 1.5 B revenues split between subscription and merchant solutions.

The subscription product is essentially the access to the e-commerce platform and was crucial to jumpstart the company, but the merchant solution is where the company is investing more and where they probably expect to build a moat.

Merchant solutions now accounts for 59% of Shopify’s revenues, and counting. This line includes a constellation of extra services that support the merchant in many non-commercial activities, such as:

- Shopify Payments

- Shopify Shipping and Fulfillment

- Shopify Capital

Balance Sheet

Shopify’s balance sheet is really a fortress with minimal leverage and a lot of cash available.

Statement of Cash Flows

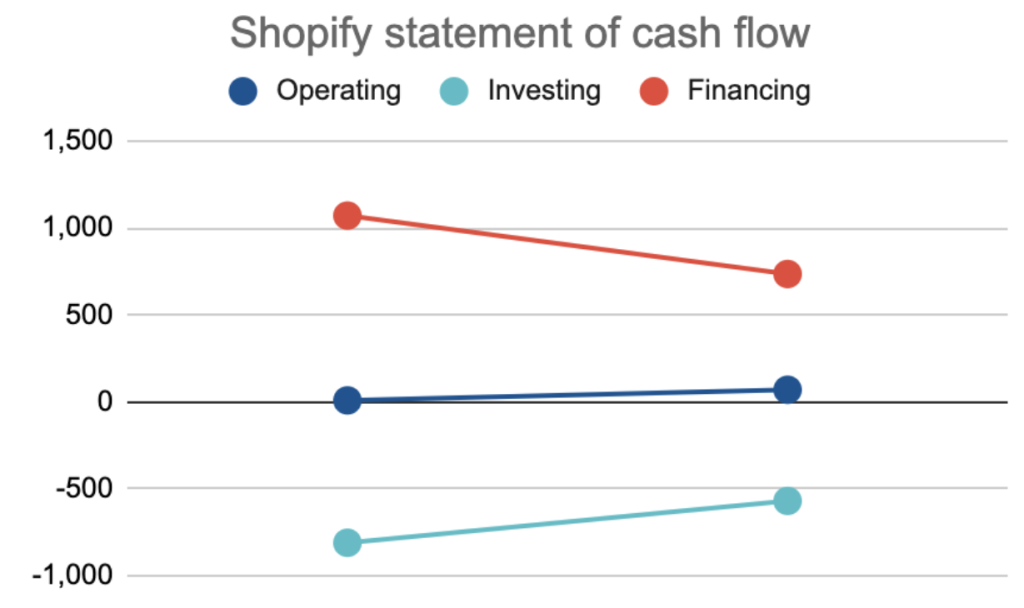

Shopify’s statement of Cash flows is very insightful, as it really shows a company in its growth phase: the financing flow started to go down but is still very strong, the operating flow starts to take off and the investing one is diminishing but still deeply negative.

Leveraging the platform: embedding finance

The last Shopify Reunite saw a number of announcements with Money and Financial features at the centre of the stage. Many of their products pose a direct threat to many incumbents and pure Fintech startups:

| Feature | Threat to: |

| Shopify balance: A business banking account and loans for merchants. No fees or minimum balances. This will include a Shopify customized virtual and/or physical debit card and cash-back cards | Retail banks, neobanks for SME. Any new e-commerce will probably use either Shopify or Amazon. They will easily be acquired also on the banking side. |

| Shopify Capital: The company expanded their lending infrastructure. Lent $1 billion to merchants so far, in ticket sizes ranging from $200 to $1 million. | Retail banks, SME lenders. See above, only for lending (with better underwriting opportunities). |

They also announced some customer-facing features that want to rival with more customer facing brands:

- Installment payments via Shop Pay, with the option for users to break purchases into 4 even payments at 0% interest.

- Shop App: Less fintech and more Amazon competitor, with better merchant features and 16 million users so far.

To be honest, I’m very skeptical about this consumer-facing twist: first, building a consumer brand that rivals Amazon or even Facebook is extremely complex and defocusing for a platform company; second, and more important, this also introduces a mismatch of incentives between Shopify and its customer base: the merchants.

One of the perceived value of Shopify over Amazon, is the fact that Shopify is considered a tech partner that doesn’t want to screw you up because it doesn’t consider your margin its opportunity. This partnership narrative may be at risk in a more prominent D2C role.

Looking ahead

Shopify is an extremely solid company, with a great outlook for the future. They are placing themselves at the center of the future of commerce, providing a comprehensive infrastructure that makes the life of the merchants much easier, and let the company focus on serving customers better and with minimal financial and logistic hussle.

Their focus on financial features is the nth signal that embedded finance is a key trend that also other platforms are embracing (see Amazon partnership with Goldman Sachs).

In this world, incumbents and pure fintech startups have to find a way to clearly define themselves, but I’ve already tackled this point 🙂 .

Resources

- Shopify Financials – LINK

- Amazon GMV by Marketplace Pulse – LINK

- Forbes on Shopify – LINK

- Shopify ReUnite 2020 – LINK 1 – LINK 2 – LINK 3

- Shopify Balance by TechCrunch – LINK

- Stratechery: “Platforms in an aggregator world” – LINK

- Stratechery: “Shopify and the power of platforms” – LINK

- CNBC on Amazon and Goldman Sachs partnership – LINK