Almost two years ago, in the middle of the pandemic, I decide to start a blog to document my journey in a world that I found extremely fascinating: the intersection of technology and finance. This is how Fintech Ruminations was born. After two years covering many different topics and verticals, I am changing Fintech Ruminations focusing even more on my biggest interest in the space: the migration of Real World Assets to DeFi. From now on, I will be writing every 4 weeks on the topic and the one below is the first post of this new course.

Financial systems are in the business of facilitating economic transactions: a financial system survives in the long run only if it ensures that transactions performed within it produce better results than being run without the financial system itself.

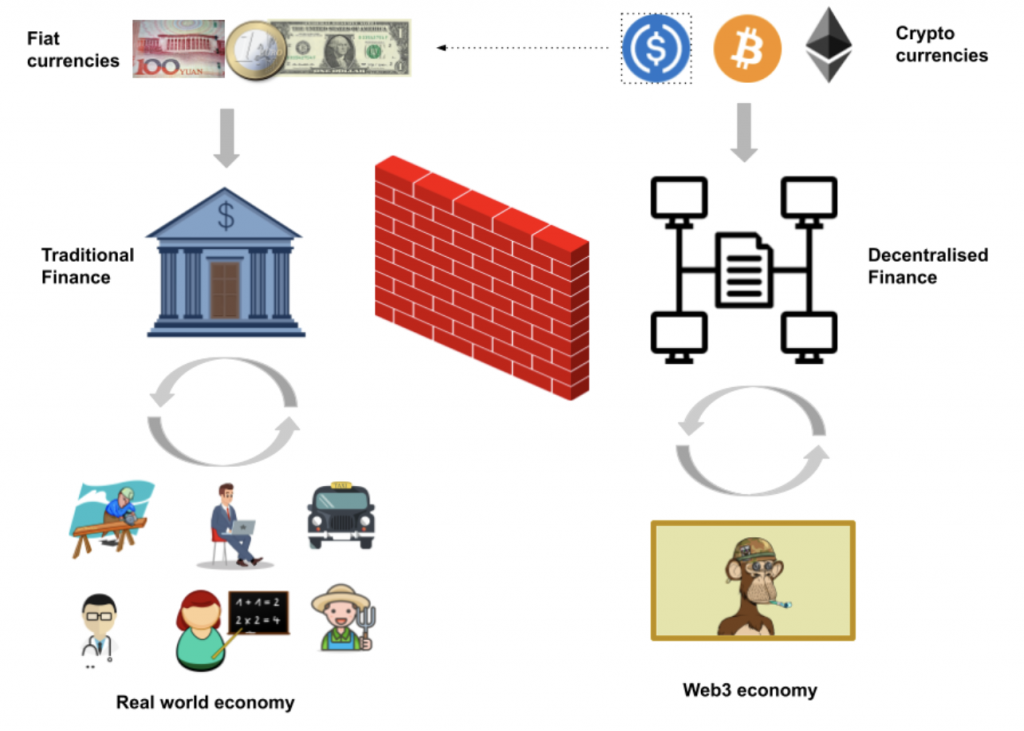

In the last few years the traditional financial system has found a competitor: Decentralised Finance. The ultimate goal of decentralised finance is to build a new financial system that will slowly replace the existing traditional one. This new system has the ambition to power the global economy, starting with new web3 economic interactions and slowly eating out the other use cases and transactions.

The new DeFi rails have 3 key characteristics:

- Transparency – transactions are written in public databases called blockchains,

- Permissionless – anyone can use these rails with no need of being vetted or approved,

- Code-centric – transactions are essentially executed by a global virtual machine and fundamentally enforced through code.

In this new financial system a foundational building block is represented by decentralised credit marketplaces: services through which capital is deployed in a cheaper and standardised way through permissionless and trustless applications, called protocols.

The goal of this post is to provide a deep-dive in one of these decentralised credit marketplaces Credix, to analyze its capital-markets-as-a-service proposition and contextualize it in the wider lending space.

The nature of the lending business

The lending business is characterized by two major phases: the phase of raising capital from providers and the phase of distributing capital to borrowers.

In the first phase, the capital funding/sourcing, the lending company has to find ways to attract a decent amount of capital at a cheap price. The price that the lending business pays is expressed in the form of returns that are distributed to the capital providers – aka investors. Banks are traditionally the most successful institutions in this activity as they manage to attract capital for free, promising a safe house to the money of its capital providers, aka depositors.

In the second phase, known as capital deployment, the lending company has to make sure that the capital raised in the first phase is deployed, i.e. lend out, to sound businesses and individuals, guaranteeing an adequate remuneration for both the capital providers seen in the first phase (investors) and for itself.

The last decade of fintech innovation has seen a lot of evolutions and developments in the way capital deployment works: credit products have taken new forms and found new distribution avenues, but very little has changed in the capital funding phase.

DeFi has built a parallel financial system which is competing with the traditional system. The new DeFi protocols, leveraging the property of automation, permissionless and trustless, promise to deliver a more efficient capital sourcing and capital deployment process.

At the moment this new system has essentially attracted only web3 use cases (yield farming, leveraged crypto lending) but some new applications are working to diversify the use cases and connect the crypto financial system to real-world applications, currently monopolised by traditional finance rails.

Credix is one of these.

Enter Credix

Credix is a decentralized credit marketplace, built on the Solana blockchain, that enables an efficient origination and servicing of undercollateralized loans.

The problems that Credix is trying to solve are two: on the deployment side, to connect real-world alternative lenders to more efficient sources of capital for a fraction of the price in a radically easier way; on the sourcing side, to offer appealing returns to investors.

Credix doesn’t lend out to individual companies but it is lending money to alternative lenders active in emerging markets. Essentially, Credix is building a new global and standardized way for alternative lenders to access capital markets – what could be defined as Capital-markets-as-a-service.

Every alternative lender that wants to challenge incumbents has two fundamental (and very hard) jobs to do:

- #1 Identify a niche of customers that it could serve better than the others – better distribution or better underwriting

- #2 Convince investors that the loans they are originating are safe and profitable investments

#2 is a more obscure role but essential to the success of the venture and it is controlled by the Capital Markets function. This function – usually made by ex City or Wall Street bankers jumped into fintech – has the goal to provide a steady flow of as-cheap-as-possible capital to the company. These people are the ones in the company that speak the language of the investors, know how to convince them, know how to structure the deals and how to engage with them as the deal starts maturing (reporting standards).

What Credix is trying to do is to replace the Capital Markets function of alternative lenders, providing a structured, programmatic and easy-to-integrate marketplace to untap capital.

They decided to focus initially on LatAm as it is the economic area with the biggest fintech penetration and, simultaneously, the biggest funding needs, with very hard access to capital. These conditions create a strong demand for Credix products.

How credix works

As already mentioned, Credix provides undercollateralised loans to alternative lenders so it gets, as a guarantee, a collateral which has a lower value than the loan disbursed. This implies the need for an underwriting layer, which in Credix case is provided by a group of third party agents not employed by Credix that assess the creditworthiness of the borrowers.

Also, Credix doesn’t fund the loans originated with its own balance sheet: it aggregates the capital of the liquidity providers in Liquidity Pools that are then used to disburse loans to the lenders when approved by the Underwriters.

There are 3 specific abstractions in the protocol: liquidity providers or LP, underwriters and deals.

LP – liquidity providers are the investors providing the liquidity. They deposit their money in liquidity pools which are essentially revolving credit lines from which loans are disbursed and where interests are repaid. LPs get a token in exchange for their deposit: the LP token.

The LP token represents a claim that the investor has on the liquidity pool and the LP token prices reflect the capital gained off all deals.

Underwriters – these are the third party agents not employed by Credix that evaluate the deals in which the liquidity pool will then invest. Typically institutional investors or high-net-worth individuals, they run the due diligence process to assess the creditworthiness of the borrower and provide the first loss capital that will absorb the first losses. In exchange for their activity, they also get a token: the UW token.

The third key abstraction of the protocol, and also its core element, is the deal. This represents the future loans once approved by UW, and then funded by LPs.

Each deal has:

- an amount,

- a financing fee (% interest rate),

- a time to maturity (#days after which the principal has to be repaid),

- an UW fee (performance fee – % of interest taken by UW on the repaid interest rate)

- a leverage ratio

The last and most important property of the deal object is the leverage ratio.

The leverage ratio defines the financial structure of the deal, so how the deal will be funded respectively by the Underwriters and the liquidity providers.

Credix adopts a traditional junior/senior tranche structure: the UW will cover the junior tranche, while the LP will fund the senior tranche. The senior tranche will be the first one to receive the repayments of the loan, leaving the first losses to the junior one.

This mechanism is what aligns the incentives between the different parties in the protocol: the UW will approve only creditworthy deals as it is the first one to assume losses. But in exchange for this extra risk, the UW will gain exposure to potentially much higher returns, proportionate to the leverage ratio.

Once a deal is approved by the Underwriters, and the junior tranche is filled, it gets automatically filled with LP capital and disbursed to the borrower (the alternative lending company). As the time of repayment approaches, the borrower sends a repayment that is distributed in a waterfall way: Credix fee first, LPs senior tranche second, UW junior tranche last.

Positioned for success

Today Credix has originated approximately $16M in USDC of loans to a handful of LatAm alternative lenders: A55, Tecredi, Meu Tudo, Adiante, Provi and Descontanet. The average financing fee for these companies currently sits at 14.7% – by the company dashboard.

On the investors’ side, the platform has onboarded some pretty big liquidity providers among them Solana itself and Alameda Research – the investing arm of FTX. The APY provided by the liquidity pool currently sits at 13.5%.

Credix is still a very small player but they are part of a space (alternative lending) that has experienced massive growth over the last 5 years and there are enormous avenues for growth, particularly in their markets of focus (LatAm).

They are positioned in the right market and have a product that is qualitatively different from their competitors. Anyway, I believe that their success will mainly depend on their ability to attract alternative lenders and successfully equip them to compete and beat incumbents (both banks and other alternative lenders) to the point that anyone willing to start a new non-banking lending business should use Credix as the standard solution of the funding problem.

The defensibility of their eventual success is still unclear to me. As explored with Aika in a previous post on network effects in fintech, there are limited network effects taking place in P2P lending applications, but some multiplier effects could be produced by the protocol nature of the project: having companies participating in the protocol governance could make them stickier and build a sort of community moat around it. Still to be fully explored and understood.

The first crypto killer application?

Alternatives to Credix are already present on the DeFi market. Goldfinch is building a very similar solution on the Ethereum chain but presents a more tech-focused team and approach than Credix. A similar job is solved by Maple Finance and TrueFi: both protocols are in the same business of offering standardized and easy-to-untap capital to lenders, but focused on a different deployment vertical: crypto trading. In any case, the protocol dynamics look pretty similar to Credix and the expansion to real-world assets could be pretty instantaneous in the case market opportunities should materialize.

So far, enormous amounts of capital have been deployed to build consumer products for crypto but, besides speculation and pretty fringe use cases, no one was really able to change people’s life.

Given the back-end nature of the blockchain technology, I suspect its diffusion will take place in more subtle ways. In particular, blockchain has proved to be fundamentally better at solving problems of incentives alignment and trustless transactions, all particularly prominent in the space of finance.

Whether it will be Credix, Goldfinch, all of them, or any other players, I do believe that Capital-markets-as-a-service applications could seriously be the first killer applications for crypto protocols, the first ones able to distribute this technology to the masses. The next few years will tell us if crypto has finally found its problem to solve.