The microcosm of DeFi has been highly successful in the last few years in creating a set of new financial rails based on a new paradigm.

These financial rails have been extensively used by a niche of power users who played with them in many different ways, with the clear goal of speculating.

So far, a very limited intersection exists between the new DeFi rails and off-chain economic activities. Still, if the DeFi space wants to change the (financial) world – as they constantly claim – it is absolutely necessary to multiply these on/off-chain intersections.

In my previous posts, All you need is bond, Centrifuge and Credix, I presented a set of projects working to bridge off-chain economic activities to DeFi rails.

The following post will continue this investigation, this time focusing on another set of companies that are working to make the bond market more efficient and accessible through tokenization.

A lot of announcements so far

The introduction of primary bond issuance on blockchain rails has been repeatedly announced but has yet to see mass adoption.

Just a few days ago, Bitfinex announced a historical first issuance on-chain, which follows many other announcements. In 2019 Santander announced its first end-to-end bond issuance on-chain; this was followed by – among others – the World Bank in 2020, the EIB in 2021 and Siemens in 2022.

After these interesting but sporadic initiatives, on-chain primary issuances of bonds didn’t take off. But now, things seem to be warming up with various platforms emerging, both from startups and incumbents.

Tokenization platforms all around me

On the startup front, a very interesting emerging project is Obligate.

Obligate is a Swiss startup that issues directly on-chain SME bonds. Funded a few years ago, it has raised $8.5M, and it launched its platform earlier this year in March.

The platform is a typical two-sided marketplace: investors, willing to buy bonds, on one side and companies, willing to raise money through bonds, on the other.

The products issued on-chain are eNotes: bonds in the form of ledger-based securities according to art. 973d et seq. of the Swiss Code of Obligations. The eNotes are issued purely digitally as ERC-20 tokens on Polygon and can be freely transferred to third parties. eNotes work as bearer instruments: the person holding the eNote and registered on-chain will get paid (only if the holder can pass KYC/KYB).

Similarly to traditional bonds, eNotes issuance starts with a book-building phase in which terms and allocation are established off-chain. The Obligate bonds can be collateralised, but it seems unnecessary for the issuance of the token itself. When an agreement is reached, Obligate issues the bonds on-chain, minting the tokens that are then distributed to investors in exchange for USDC or EUROe.

Throughout the bond lifecycle, Obligate’s eNote protocol will also be in charge of collecting payments and distributing them to the investors.

In case of missing payments or bond default, Obligate’s eNotes claims will have to be enforced through an arbitration in Switzerland.

Will this fly?

Obligate’s proposition on the company side seems very interesting: it is a more efficient way to raise money, further diversifying the sources of capital.

On the investors side, the story is more complex.

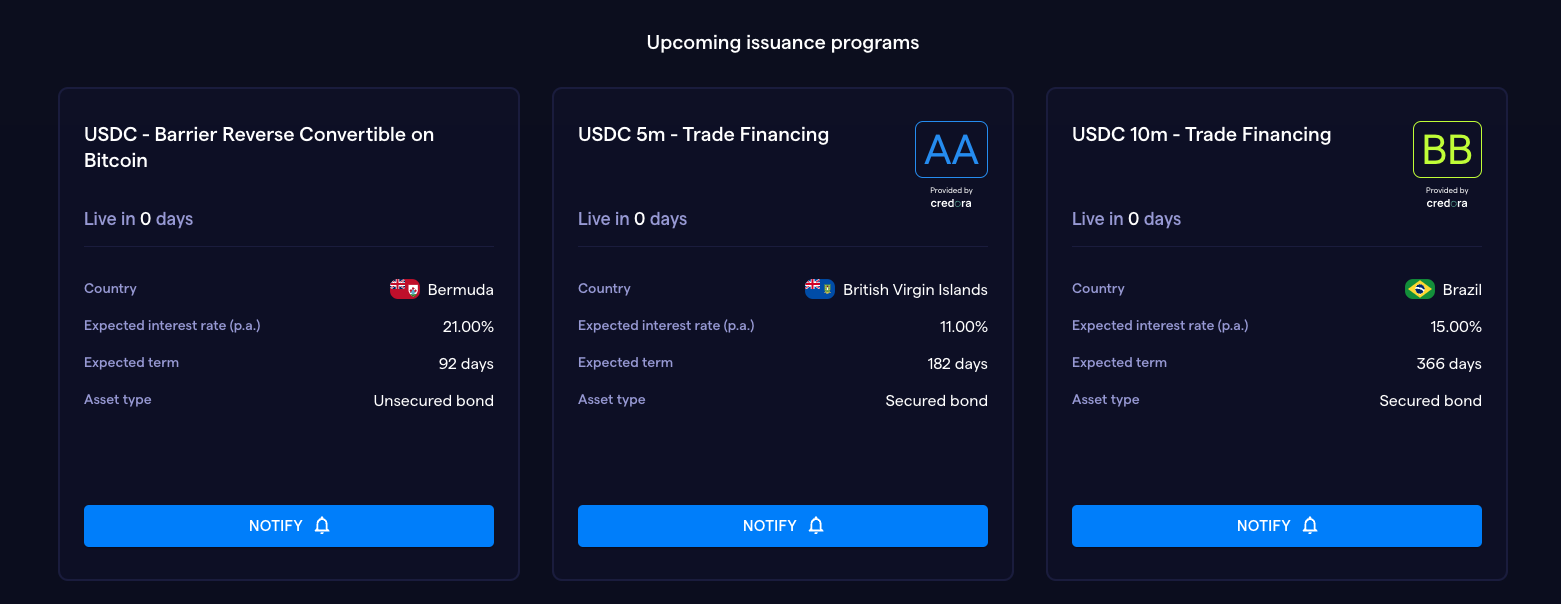

Every bond on Obligate comes with credit scoring provided by Credora, a privacy-preserving technology that provides independent ratings.

Credora’s rating is an interesting approach, but being a much younger organization, it cannot provide the reputation that more traditional players like Moody’s, Standard & Poor’s, or Fitch can offer. This lack of a solid name in the rating of its bonds could result in trouble attracting institutional capital.

A second potential limitation is the lack of deep secondary liquidity.

A key property of the global bond market is its enormous secondary market liquidity. Obligate’s bonds, right now, have very limited secondary liquidity: the tokens are only transferable among whitelisted wallets within Obligate’s native, permissioned marketplace. Meanwhile, some OTC capabilities are being developed but are not currently available.

Overall, Obligate’s tokens are not available on any DEX or CEX, and they appear essentially insulated from the rest of the DeFi ecosystem and, thus, with minimal opportunity for exchange: once you buy them, you hold them.

This could be a significant hurdle to its adoption among investors, both in the DeFi space and the TradFi one.

Competitors

Obligate is not the only startup trying to emerge in the race to tokenize bonds. Other names in the space are Intain, Defyca and, in particular, PV01.

Funded by the founders of B2C2, a big name in crypto market making, PV01 wants to build a native digital platform for debt capital markets. The platform is not live yet, but it will launch soon with its Onchain Treasury product.

In parallel, many incumbents are investing enormous amounts in proprietary tokenisation platforms. A few examples are JP Morgan’s Onyx, Goldman Sachs’ DAP, Broadridge’s Distributed Ledger Repo, Société Générale’s SG-Forge platform, and Euroclear D-SI (Digital Securities Issuance) service.

The common denominator of all these projects is their closed and non-disruptive nature: they are walled gardens mainly built to bring more efficiency to internal banking processes, but they don’t epitomize a new paradigm of finance. They simply make the previous one more efficient.

Conclusion

“I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

James Carville, Bill Clinton’s political adviser

The bond market is the biggest market on the planet, and the opportunity that comes with its innovation is huge. Various players are competing to re-invent it, and right now, incumbents seem better positioned, given their radical distribution and existing penetration in the global financial space. Interesting DeFi startups exist, but none of them have yet fully nailed down the right angle to start capturing this market.

Nonetheless, huge technological shifts were very rarely captured by incumbents. Traditional players have enormous advantages, but they hardly embrace the values of the new paradigm, and this is usually what it takes to win the market in the new technological paradigm. I bet that this will be true also this time, and the new market dominators will be those embracing the true ethos of the DeFi movement: liquidity and transparency. The race is on.